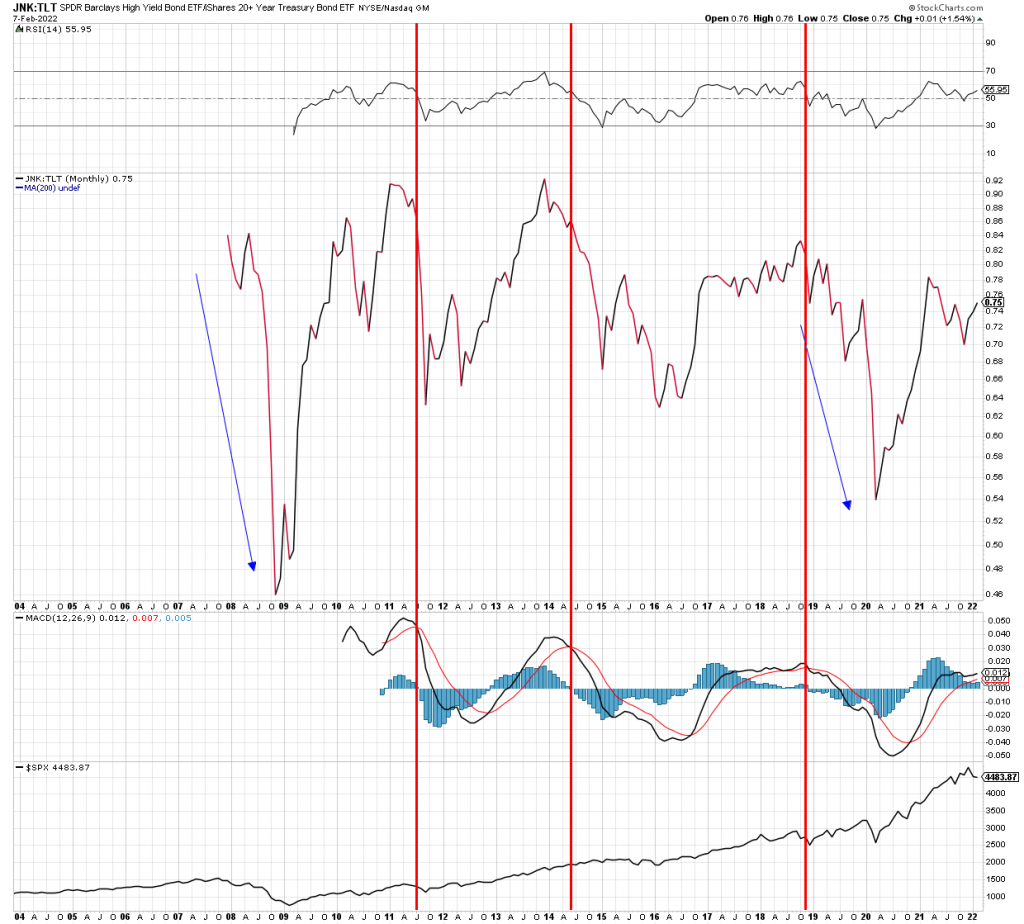

One very useful tool to gauge the future trend is to see the high yield market. When there is genuine fear and risk aversion, the high yield market factors that in and prices fall.

See the monthly chart of high yield vs Treasury Bonds. In periods like 2008, 2020 high yield prices crashed relative to TLT. A simple monthly MACD bearish cross is an early warning tool for bearish periods ahead.

The chart is healthy now and shows no major fear ahead. While near term volatility and small corrections might continue, based on what we see now there is no reason to be entirely bearish.